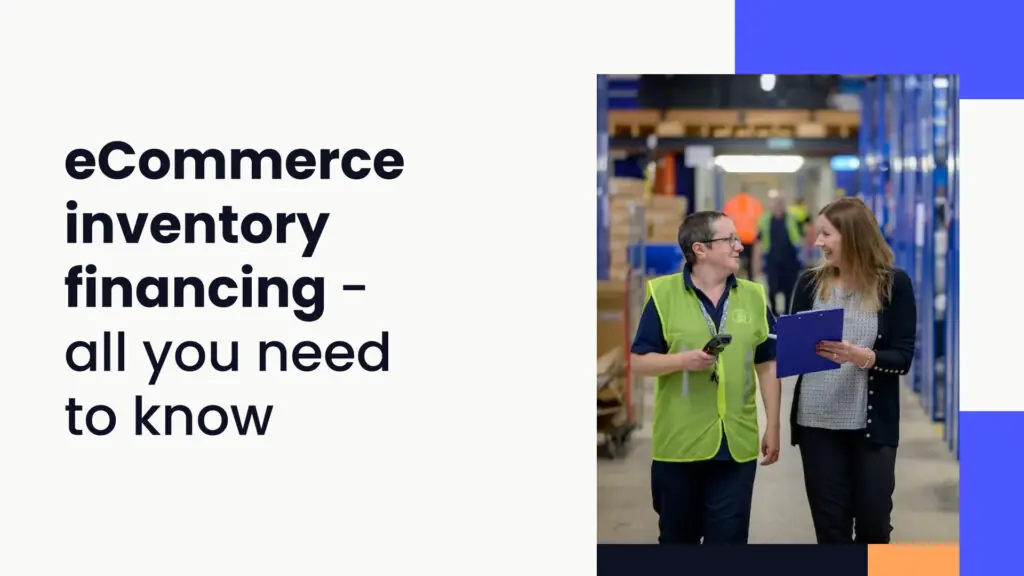

eCommerce is growing at a dizzying and seemingly never-ending pace. Forbes reported that the industry surpassed $1 trillion in sales in 2022, the first time this has happened. It’s as good a time as ever for sellers to enter this blossoming market. To do so and succeed will take serious capital. This is where many businesses turn to eCommerce inventory financing and inventory loans. It is one of the best ways to fund the large orders of products that are necessary to avoid running out of stock.

Fund your inventory with 8fig!

In this guide, we will explain what inventory financing is and how it can help you grow your business.

What is eCommerce inventory financing?

eCommerce inventory financing is a type of small business loan that covers the cost of goods that a company wants to sell. Companies with cash flow issues turn to this solution to pay for their next batch of products. It can be necessary for many eCommerce sellers since they often need to order two or even three freight shipments before the first starts selling. This is done in order to keep up with demand and avoid stockouts.

Businesses that don’t have large cash reserves on hand seek out inventory financing to establish themselves and build long-term growth. A great moment to seek out this option is when you know a high sales volume period is approaching and you want to ensure your products will be available throughout it.

How does inventory financing work?

First, depending on your business type, you’ll need to consider what inventory you need and the amount of funding required to purchase it. Proper sales forecasting is important here as it can help you plan exactly how much inventory you will need over what period of time. This is essential as sending in orders that are too large means they might require longer storage periods to sell out, resulting in extra warehousing costs.

Next, you approach a lender with your forecasted inventory needs and apply for financing according to their guidelines. Each lender has varying requirements, so it may take some research to find the right one for you. They usually offer 50-80% of the inventory’s value, but some can even offer 100%.

You have to keep in mind that whatever percentage of the product’s cost isn’t covered by their financing will have to come out of your own pocket. Taking out another loan is also a possibility but you want to make sure you don’t overburden yourself with fees and interest payments.

ECommerce inventory financing can help you refill your stock but it also comes with an APR (annual percentage rate) that can range from lows of 4% to highs of 99%. A repayment period typically lasts three to twelve months. This is contingent on the lender, the conditions of the deal, and your company’s credit situation. Locking yourself into a bad deal can seriously disrupt your business growth so be sure to compare as many options as possible to find the best deal for you.

We’ll ask a few quick questions to better understand your specific business needs. Then, we’ll build a funding plan tailored to your expenses.

Subscribe to the eCommerce newsletter for

top industry insights

Once you have the funds, you are only able to spend them on products agreed upon in the terms of your deal. If you have an idea for a new product or want to spend the money on marketing, you cannot use this financing as it would likely breach the terms of your agreement.

Note: Some lenders require an appraisal fee so they can assess the value of the products you want to order, as well as your business operations and creditworthiness.

Inventory financing types

There are two main types of inventory financing available to eCommerce sellers. Your choice will depend on the amount of inventory you need and your ability to pay everything back.

Business term loan

Business term loans or inventory loans are often easy to obtain since the inventory itself acts as collateral to secure the loan. The financing is provided upfront and paid back on a monthly basis. This is a good way to order a large batch of inventory, which can mean a lower per-unit cost for you. Lenders carefully assess the value of the products a company wants to buy before agreeing on the final sum. Business term loans tend to involve reasonable interest rates.

The downside is that a lender will perform regular evaluations on your inventory, so it is essential that you keep accurate records. Some lenders have a minimum loan amount that may be too high for small businesses to meet. If you get approved, you may not acquire the full amount you initially requested, so you need to make sure you have the extra funding needed to pay for your planned inventory order.

Inventory line of credit

An inventory line of credit is similar to a regular line of credit, except you can only use the funds for inventory needs. Usually, it comes in the form of a revolving credit line, so you get access to more funding each time you pay back your previous loan, similar to a credit card. This can cover regular orders or last-minute purchase orders.

These types of loans are easily obtained, even more so than an inventory loan. They tend to have very lenient requirements and will help you increase your credit score. That means potentially better loan conditions further down the line. The lender doesn’t control your spending schedule, so you can pull money out of the account when you need to.

However, due to the lenient requirements and flexible financing, you’ll have to pay higher interest. The borrowing limit is often on the lower side, as well. So, if you have a high sales volume, this type of inventory loan may not cover all of your planned expenses.

Who qualifies for inventory financing?

Getting approved for eCommerce inventory financing will depend on the amount you request, the interest you can afford, and your business history. Each lender has different conditions for inventory loans, so you should do some research to find the one that fits you best. However, this type of funding is typically easy to obtain if you can provide satisfactory data regarding your forecasted sales, suppliers, warehouse, and sales channels.

It is important that your business is already bringing in decent revenue to show lenders that you are likely to pay back the loan.

Might also interest you:

How to apply for inventory financing

Exploring and weighing all the eCommerce funding options available to you can be overwhelming. There are a lot of factors to consider, and the type of loan you choose will have a major impact on the long-term success of your business. It is important that you take your time to weigh the conditions of potential offers. Additionally, you don’t have to take any offer that comes your way.

Financing providers typically give you 30-90 days to consider before withdrawing. Look at other companies to compare them to and perhaps even use one provider’s offer to negotiate better conditions from a competitor.

Good credit isn’t essential

While some inventory loan providers will also take your credit into consideration, good credit is not a requirement. The fact that the goods you intend to buy become collateral is a strong assurance for lenders. This means having a poor credit score, which might disqualify you from a bank loan, is not a deal breaker. Inventory loans are accessible for almost all types of businesses, big or small.

No personal guarantees

Some loan deals might stipulate that a company’s owner has to offer personal assets as collateral in order to qualify for financing. This means that if your business is unable to repay everything, the lender has the right to seize personal assets from you. It can be in the form of a car, savings account, or house. With inventory financing, there is no risk of this happening since the inventory itself becomes the collateral.

You get your funding much faster

Unlike with a traditional bank loan, which can take as much as a few months to get approved, inventory financing can be acquired in relatively little time. If you meet all the lender’s requirements, your loan is likely to get approved within one or two weeks. This speed makes a huge difference for small eCommerce businesses that are dealing with short-term financing issues and need capital to respond quickly. Inventory financing also involves a lot less paperwork than a regular loan would.

Who should apply?

Inventory financing doesn’t have a one-size-fits-all model. It is meant for companies that:

Popular content

View articles

- Have cash flow issues and need more financing.

- See high turnover rates regularly.

- Weren’t able to get other forms of loans.

- Require funding that is adaptable to their needs.

- Have at least a somewhat substantial sales history.

- Don’t have too much debt already.

A different solution

If eCommerce inventory financing doesn’t appear to be the right choice for your business, you should consider applying for an 8fig Growth Plan instead. This entails getting regular cash injections to fund your operations.

Unlike with inventory financing, you can spend this money wherever you want, whether it be a new line or products or an expanded marketing campaign. You won’t have to offer anything as collateral and get to stay completely in charge of your business. Instead, you agree on a cost of capital before sending remittance payments over an agreed-upon schedule. There are no hidden fees or interest.

Finally, you get access to 8fig’s platform, which facilitates managing and overseeing your supply chain. Take your next step as a business and sign up for your own personalized Growth Plan.

Have article ideas, requests, or collaboration proposals? Reach out to us at editor@8fig.co – we’d love to hear from you.