- What does cash flow mean in the context of online selling?

- How cash flow affects eCommerce businesses

- Good cash flow vs bad cash flow

- Why it’s an issue so many struggle with

- Biggest eCommerce cash flow challenges

- How effective cash flow management promotes growth

- Case study: how Glitch Energy overcame cash flow issues

- Best ways to optimize cash flow

- Exclusive cash flow tips from a 7-figure eCommerce seller

- Cash flow planning tools

- AI’s influence on cash flow

- In summary

Maintaining healthy cash flow is one of the central pillars of running a successful eCommerce business. Having the funds to pay suppliers and shipping partners or invest in product research and marketing is incredibly important. Being unable to respond to unforeseen expenses, which are very common in the highly dynamic world of eCommerce, can bring your whole business to a standstill.

Succeeding in this industry requires the ability to respond fast, whether to invest in a trending new product or replace a lost inventory shipment. In this article, we will explain the importance of cash flow management, and how eCommerce sellers can ace this process.

What does cash flow mean in the context of online selling?

ECommerce cash flow refers to the movement of funds into and out of a business, and how much capital is accessible to at any given time. It serves as an indicator of the financial health of a company. Effective cash flow management ensures that an online store has sufficient funds to purchase inventory, invest in marketing, and expand its operations, while also being able to cover other operational costs like packaging and shipping. Unlike traditional brick-and-mortar businesses, eCommerce sellers often face unique challenges in cash flow management. This can come in the form of digital payment processing fees, dealing with returns and refunds, or ensuring that items are shipped from the supplier to the warehouse and then to the customer in time.

Disruptions to cash flow can be common in eCommerce, via lost sales from a late shipment or unforeseen expenses from a faulty batch of inventory. Understanding and managing cash flow effectively is therefore essential for the sustainability and growth of an online store.

How cash flow affects eCommerce businesses

Online sellers have to ensure that they have the healthy cash to cover unforeseen expenses that could disrupt their business operations. For example, if a shipment of inventory gets lost, the store has to replace it immediately or they will run out of stock, freezing all revenue from sales. Without other means to raise capital, this situation can become the death sentence of a business. Poor cash flow is one of the biggest reasons for small businesses closing down.

Good cash flow, on the other hand, meaning that a business consistently has access to the capital it needs, can allow a business not just to persist, but to invest and grow. For example, it could put more money into a new marketing campaign to increase demand and sales. Or it could develop new products, opening up alternative sources of revenue. This opens the door to bringing in more capital, which in turn can be invested elsewhere.

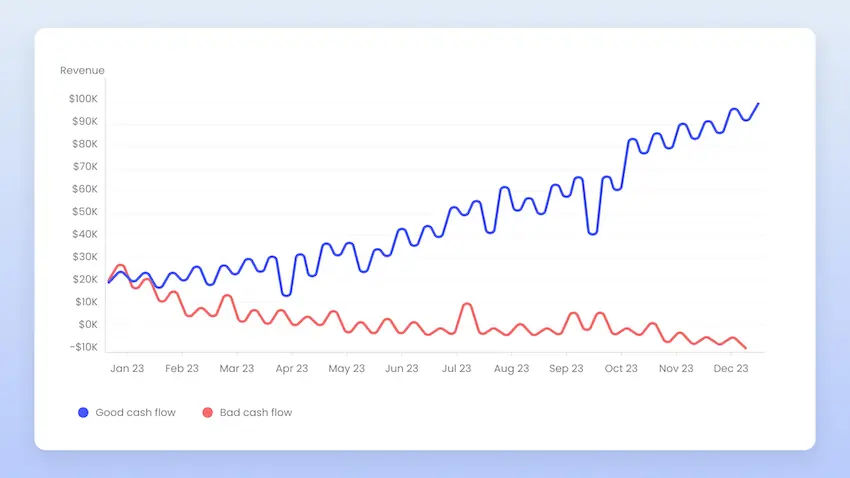

Good cash flow vs bad cash flow

In this graph, you can see examples of good and bad cash flow management. Optimizing cash flow to your business needs by investing in avenues of growth while also ensuring that you can cover all expenses on deadline day is essential for success. Investing properly mean occasional dips will occur, however, it is very important to avoid going into the negative. That’s when bank and other fees start stacking up, which can disrupt a whole business.

Subscribe to the eCommerce newsletter for

top industry insights

Why it’s an issue so many struggle with

Cash flow management is complicated for so many online sellers because it requires excellent oversight and a great ability to prepare for unpredictable scenarios. For example, during the COVID-19 pandemic, many online stores saw their supply chains disrupted, as global shipping networks came to a halt. ECommerce is also uniquely dynamic, a spike in product returns or a drop in demand due to shifting trends can disrupt a business’s profit margins very quickly. Positive changes are also common, of course. A TikTok trend could multiply demand for your product overnight, as could a tweak to Amazon’s search algorithm. Boosts in sales are always nice, but eCommerce sellers need to be ready to handle disruptions to their cash flow.

Biggest eCommerce cash flow challenges

Stockouts

Running out of stock can be one of the biggest headaches for online sellers. It may seem that this occurring means success: lots of customers like your product. But there are several downsides. Off the bat, it signifies lost sales and decreased store ranking. The latter happens because sites like Amazon have an incentive to show shoppers products they can buy right away. This means that positive momentum regarding your products’ listings is disrupted and wasted, as competitors jump in to meet demand. Stores often invest heavily in PPC (Pay Per Click) campaigns to widen their reach and rank higher, meaning this progress is undone with a stockout.

Responding to unexpected expenses

Every eCommerce store owner should make sure they are ready for unforeseen costs. Good cash flow means you have the ability to cover such expenses. If you sell on Amazon and it chooses to raise storage costs for Black Friday, for example, you need cash on hand to cover this. Especially before periods like the winter holiday season, when lots of shopping is done, you will need capital to order enough inventory in advance to avoid stocking out.

A batch of products being faulty, even if you can get reimbursed by your supplier, can result in a huge short-term expense. You will have to pay for a new order, as well as expedited shipping, perhaps via airmail, unless you want to wait the 1-2 months it will take to arrive.

Another scenario could involve a new product you’re launching not taking off and selling as well as you had hoped. One productive response to this situation is to run a larger PPC campaign to generate interest. That means a bigger short-term expense in the hope of better long-term gains. Good cash flow management can allow you to respond to such situations quickly and efficiently, with minimal disruption to your sales.

Might also interest you:

- What it means to be a cash flow positive eCommerce business

- The complete guide to eCommerce cash flow forecasting

- 11 dos and don’ts for efficient eCommerce cash flow management

How effective cash flow management promotes growth

Good cash flow management also allows businesses to plan ahead better. Having a lot of cash on hand means you can invest it in a new product or improved services, like faster shipping. Reading customer reviews, discovering common pain points, and then creating an upgraded version of your product is a great way to invest in your business’s future. Good cash flow means an improved ability to grow over time.

Another benefit is being able to order larger batches of inventory, meaning a lower per-item cost, improving your profit margins. Similarly, better cash flow allows you to make future orders further ahead of time, with slower shipping that is less costly, once again saving you money in the long run.

Businesses with poor cash flow have a much more limited ability to plan ahead. They simply lack the funds to make investments that don’t pay off right away. Often, they find themselves having to pay for smaller batches with faster shipping, which reduces profit margins.

Once your business grows to a certain size you can also expand to new markets, creating additional revenue streams. Again, building this growth relies on good cash flow in order to make investments that might not pay off for many months.

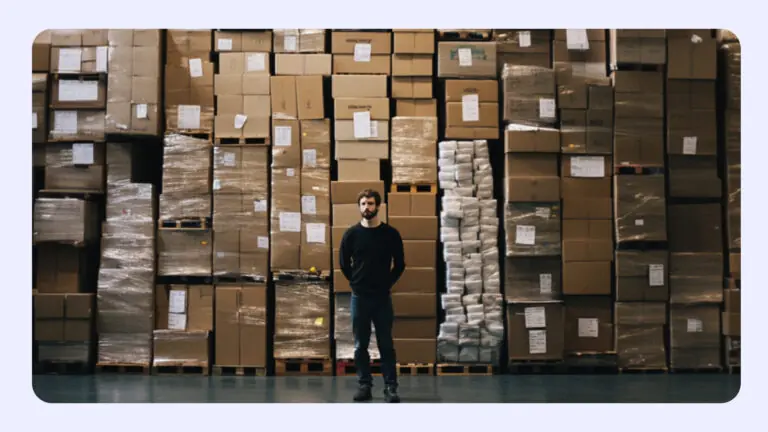

Case study: how Glitch Energy overcame cash flow issues

Jacob Johnson launched Glitch Energy, a premium natural energy powder for gamers, in 2021. Kicking off with a detailed business plan, he partnered with a YouTuber called Wildcat, who helped build a large audience quickly. Meeting this surging demand became an issue, so Glitch faced regular stockouts that seriously disrupted their sales growth. Jacob knew that to solve this issue he would need to set up a large, well-oiled supply chain. Lacking the capital to do so, he sought out external funding.

A Venture Capital firm made Jacob a lucrative 7-figure offer. However, investors demanded a share of revenue and a quick exit strategy made this deal less appealing. Instead, Jacob got flexible funding from 8fig and never looked back.

Even though COVID-19 was rattling global supply chains, Glitch reached 7-figure sales. Capital from 8fig allowed it to invest in inventory to eliminate stockouts as well as new product lines. This flexible funding meant Jacob could quickly request more cash injections when an unforeseen expense arose, or delay remittance payments when sales slowed. Glitch was able to scale its operations exponentially, creating new creative flavors, invest in larger marketing campaigns, and keep its audience growing.

You can read the whole story of Jacob’s partnership with 8fig here.

Best ways to optimize cash flow

Good cash flow management doesn’t necessarily mean sitting on a lot of capital at all times. Capital is much more valuable to a business when it’s invested in ventures that create growth. This means that ideal cash flow management involves overseeing your operations in a way so that you always have enough cash coming in to cover expenses. Still, disruptions can undermine this balance, meaning businesses need to have a plan B ready.

External funding is a great solution for covering urgent short-term expenses to promote long-term growth. For example, getting the funds needed to pay for a faster alternative when one of your shipments is held up can reduce the losses that would have been caused. Funding from 8fig is meant for such purposes.

Unlike a bank loan, which is given in one lump sum, you get several cash injections with 8fig. These are planned according to your cash flow schedule so that you can cover expenses that come up, while also bringing the cost of capital down. 8fig funding allows you to cover operating costs, as well as invest in new ventures that open more revenue streams. Building long-term growth is hard when cash flow isn’t consistently optimized.

Additionally, businesses can try to reduce risk in their operations to improve long-term cash flow. Here are some strategies from 8fig’s co-founder and CRO Roei Yellin that can help you protect your bottom line:

- Make sure you are profitable from day one. Don’t try to build your brand and audience by selling for a loss, it will destabilize your cash flow, which will hamper long-term growth.

- Go over your balance sheets and cut costs wherever possible. Pay close attention to sales analytics and forecasting, and make sure your financing is cash flow-friendly.

- Focus on profit margins. Many sellers make the mistake of focusing on revenue, only to overspend on marketing campaigns, price products too low, or offer large discounts, to maximize sales. Instead, shore up profit margins by negotiating lower prices from suppliers, strategically raising prices, and avoiding offering big discounts.

- Pay close attention to marketing metrics such as ROAS (return on ad spend), or ACOS (advertising cost of sale). These metrics will provide a good indicator of how effective your advertising campaigns really are. Monitoring them while adjusting your operations to improve them, will significantly increase your ability to stay profitable long-term.

- Optimize inventory levels. You want to find the perfect balance between avoiding a stockout and acquiring too much inventory that straps you with storage fees. Market research will prove essential here, as it will give you a better ability to predict sales volume.

- Make sure you have quick and reliable access to capital. This can be done by finding a flexible funding partner. This flexibility is key, as it will allow you to respond to disruptions, for example, a heavily delayed shipment, by getting capital to make an expedited order of inventory.

For more tips on how to maintain healthy cash flow, check out this article by Roei Yellin.

Exclusive cash flow tips from a 7-figure eCommerce seller

Popular content

- 14 strategies to improve your eCommerce business’s financial health

- 50+ ChatGPT prompts to elevate your eCommerce business

- A guide to pricing your product on Amazon

- 5 marketing metrics all eCommerce businesses should track

- All about Amazon PPC

David Lang, the co-founder of DAVAN Strategic, an eCommerce consulting firm, has an impressive track record. Together with his co-founder, Ryan Sherrard, they built and scaled a brand to seven figures, exiting in less than three years.

Despite a healthy profit margin of 29%, they opted against bootstrapping their business, concerned that slow growth would yield ground to competitors. Instead, they chose to leverage capital from 8fig to bolster their winning product lines. This strategic move skyrocketed their revenue from $73,000 in the first year to $3.1 million in the second, and then to $5 million in the third.

David lives by the mantra, “Cash is trash, cash flow is king.” He argues that excessive cash in the bank stifles a business’s potential and can give competitors an edge. Instead, he advocates for continuous investment in growth, such as launching new products or services and potentially expanding the team. The latter is important because he believes that many business owners make the mistake of working too much IN their businesses, that they forget to work ON their businesses.

He does caution eCommerce stores, however, to maintain adequate cash reserves for unforeseen circumstances, such as losing a shipment or the closure of the Suez Canal. Therefore, instead of recommending a fixed percentage, David suggests calculating necessary reserves using time as his preferred metric. For example, if it takes six months from ordering inventory to generating sales revenue, a business should hold six months of cash reserves to cover expenses for that period.

David also shares a valuable cashflow hack: The best way for a business to improve its cash flow, he suggests, is to negotiate better payment terms with one’s supplier. Rather than the standard 30% upfront and 70% upon completion, he often negotiates the following terms with his suppliers:

His business will pay 30% upfront for three months’ worth of inventory. However, instead of shipping all that inventory upon completion and paying the remaining 70% for the full batch at once, he negotiates with the supplier to store the inventory in their warehouse for free, and only ship smaller batches as needed (2-4 weeks of inventory at a time). Now, he only pays the 70% balance on the units as they shipped, effectively splitting up payments and helping his cash flow. Don’t forget, this method also gives him FREE storage, increasing his overall profit margins!

Alternatively, businesses can also negotiate to pay 30% upfront, 30% upon completion, and the remaining 40% ninety days after the products have shipped. This gives the business time to sell the products before owing the full amount, aiding with cash flow.

Note: This method does require trust from your supplier, so it is unlikely to work if you don’t have much of a relationship or business history with them.

For this reason, David recommends investing time and money into developing a strong relationship with your manufacturer – a concept known as “guānxì” in China.

For help with supplier negotiations feel free to reach out to DAVAN Strategic here.

Explore more topics to step up your sales:

- The future is AI-powered: applications of AI in eCommerce

- How to recover from a stockout

- What to expect from eCommerce consumer behavior in 2024

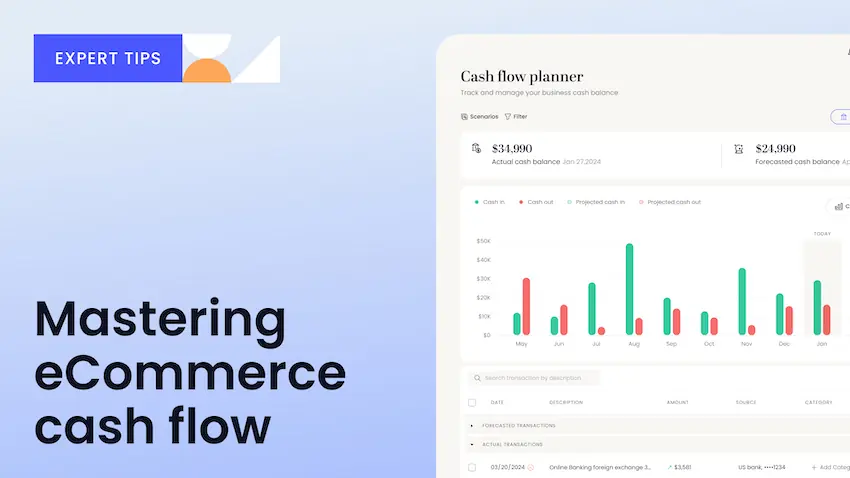

Cash flow planning tools

Cash flow planning tools can give you an improved ability to make predictions about your operations and plan ahead. ECommerce sellers can draw a lot of benefits from planning the upcoming year. These include getting a better deal from suppliers by ordering larger batches in advance and being able to negotiate better rates with warehousing partners. Additionally, you get to oversee how your finances will look, allowing for a better allocation of resources. For example, by being able to forecast how a new shipping partner might after your long-term cash flow, you can make a better judgment about whether they are worth the cost.

The process of overseeing a business’s operations is no straightforward task. You need to stay on top of every single upcoming expense, from delivery costs to Amazon or Shopify fees to covering customer returns. There are many tools that can help with this, like QuickBooks or Fathom. 8fig’s new cash flow planner is designed for this purpose. It provides deeper insight into your cash movements, as well as the ability to identify income and expense channels that are costing you the most. This way, you can make changes to your operations that benefit the overall financial health of your business.

AI’s influence on cash flow

The recent emergence of readily available Artificial Intelligence technologies has had a big impact on cash flow management in eCommerce. Many companies have taken advantage of this already by implementing AI to optimize and streamline their cash flow management. AI’s ability to quickly process large amounts of data can help companies gain more profound insights, improve forecasting accuracy, and make better informed financial decisions. Here are some key ways in which it is transforming eCommerce cash flow management:

1. Cash flow forecasting

AI allows for much better predictive analytics for forecasting a company’s cash flow. By analyzing historical data, sales trends, and external factors like market conditions, it is able to generate accurate cash flow forecasts. These predictions give eCommerce sellers a better ability to anticipate future cash needs, identify and avoid potential cash shortages, and make proactive adjustments to their operations and investments.

2. Customer behavior analysis

AI can analyze customer data to provide insights into purchasing patterns, product preferences, and buying patterns. This improved understanding of customer behavior can help eCommerce businesses optimize their inventory management, pricing strategies, and marketing campaigns.

Doing so can have a positive effect on cash flow by ensuring that resources are allocated efficiently and sales are maximized.

3. Inventory optimization

Efficient inventory management is one of the main pillars of maintaining healthy cash flow in eCommerce. AI-powered demand forecasting can help businesses better assess where their inventory levels should be, reducing the risk of overstocking or running out of stock. Optimizing inventory management can allow businesses to free up capital that was tied up in excess stock and make sure that inventory levels always meet demand.

If you want to implement AI technology that will upgrade your business, check out 8fig’s AI CFO suite. These tools powered by machine learning are designed to help you gain better oversight of your operations in order to improve your supply chain and optimize your cash flow. For example, 8fig’s cash flow planner analyzes past store data in order to forecast how future cash movements will affect a company’s capital structure. Find out how these tools can benefit your store here.

In summary

Good cash flow management can be incredibly valuable for eCommerce sellers. In fact, it is a must if you want to stay competitive in the long run and keep growing your business. Healthy cash flow means a better ability to increase profit margins, which can allow a store to invest in itself. It also opens the door to making better long-term planning, while allowing a business to respond to unexpected short-term expenses more readily.

One solution that has helped many eCommerce stores maintain healthy cash flow at all times is external funding. It provides the ability to inject cash to cover an unforeseen expense or make a big investment in the business. 8fig provides funding that is tailored to a company’s operational needs. This means it gets funded across a schedule that maximizes its cash flow to be able to invest where needed. No collateral is required and funding plans can be adjusted if things change.

8fig also gives sellers access to its AI CFO. Sellers can use this technology to oversee and analyze their supply chain, gaining a better understanding of how in and outflows of capital affect the business. This information gives an improved ability to decide where and how to invest in order to maximize revenue while maintaining healthy cash flow. Sign up for 8fig today and you get free access to its AI CFO from day 1.

Have article ideas, requests, or collaboration proposals? Reach out to us at editor@8fig.co – we’d love to hear from you.

Subscribe to the eCommerce newsletter for

top industry insights

to our blog

Read the latest

from 8fig

AI is quietly reshaping eCommerce. Karma’s Hadas Bar-Ad explores how today’s sellers are using intelligent tools to streamline operations, boost efficiency, and drive smarter growth.

WhatsApp isn’t just for memes and group chats anymore. With a 98% open rate, it’s the secret weapon your eCommerce marketing strategy might be missing. Here’s how to do it right.

Stuck with extra inventory after Amazon’s Spring Sale? Learn five smart strategies to clear unsold stock, boost cash flow, and avoid future overstocks with smarter inventory planning.