If you’re an eCommerce seller looking to grow your business, chances are you’re on the lookout for affordable funding solutions. Finding sources of funding with a low interest rate or cost of capital is a tough task, but it’s not entirely impossible. Startups and small businesses alike can use crowdfunding to finance their various projects and startup costs.

Crowdfunding is an accessible funding tool that changes the eCommerce financing game. This type of funding gives business owners control over what they give in exchange for funding. In addition, unlike bank loans and other types of funding, crowdfunding is virtually limitless and some businesses can surpass their fundraising goal.

Read on to learn more about how to use crowdfunding to fund your eCommerce business.

What is crowdfunding?

Have you ever been asked to donate money to a GoFundMe or Kickstarter campaign? If so, you probably have a general understanding of how crowdfunding works. A number of private investors like you give a few bucks to a campaign to benefit a cause or contribute to a project that you believe in.

On the social action side, we see crowdfunding used often to raise money for medical expenses, emergencies, and charitable causes. But crowdfunding extends to all types of raising capital, including funding for your business.

Crowdfunding is when individuals or businesses raise capital by collecting investments from multiple donors or investors. In exchange, investors can receive monetary or non-monetary incentives, including gifts or rewards for contributing to your campaign. These incentives are often tiered so that those who contribute larger sums of money get more valuable gifts, but those who give small investments still receive smaller rewards.

Today, crowdfunding takes place almost exclusively online. This allows those seeking funding to cast a wide net and receive investments from across the globe. Platforms such as Kickstarter, IndieGoGo and GoFundMe are popular choices. Then, many people share their campaigns on social media and through email. Potential investors can also browse around on these platforms to find projects they wish to fund.

When you start crowdfunding, you are required to set a time limit to receive funding, a goal amount, and a plan on how you will use the money. Once you meet your goal or time runs out, your campaign is completed. At the end of your campaign, you will receive the capital and begin making good on your promises to use the money for the stated purpose. It’s also important to remember to make good on your promised incentives.

Starting a crowdfunding campaign

Subscribe to the eCommerce newsletter for

top industry insights

Before starting out on your crowdfunding journey, it’s important to understand what type of campaign you are setting up. In order to catch the attention of potential investors, your campaign should be well thought out and stand out from the rest. Crowdfunding tends to work best with a unique or innovative idea, because you need to convince viewers to choose your project.

Therefore, building a campaign can be time consuming and require a great deal of creativity. If your plan or project is lacking, people will be less likely to invest. Consider including a video in your pitch, and make sure to use plenty of images and creative text. You’ll also need to come up with a plan to get the word out about your campaign. This can include a social media strategy and email blasts.

Once your campaign is up and running, your work isn’t done either. Many project backers expect to receive regular updates about the status of your campaign and project. Keep your page up to date and continue reaching out to your investors.

Despite all the hard work, many crowdfunding campaigns fail to reach their goals. According to a Fundera report, only 22.4% of crowdfunding campaigns successfully reach their goals.

The four types of crowdfunding

There are several types of crowdfunding, and the type you choose determines the guidelines you’ll need to follow to receive your funds and the incentives you offer your investors.

There is no one best solution when deciding which type of crowdfunding to choose, but one kind may produce more funding than another. In addition, you should ensure that you can actually deliver on your promised incentives.

For example, if a person offers a high tier gift for an investment of a certain size, they need to be able to provide that prize as promised. If offering such a gift or incentive will hinder your ability to complete your plan or cut into your funding, skip it and offer something that will not jeopardize your finances. If your top tier gift is worth $1,000 and you’re only raising $5,000, that’s 20% of your crowdfunding campaign coming out of your pocket. You might want to think twice before offering such a costly incentive.

1. Donation crowdfunding

Donation crowdfunding is one of the more popular options, and it’s likely the one you’ve seen in those social cause campaigns floating around social media. In this type of crowdfunding, you accept donations with no promise of prize or incentive in return.

Donations can be difficult to come by without incentives, so you have to rely on appealing to potential donors through your unique business plans. One trick is to focus on how growing your business benefits others or contributes to a cause. For example, donors may have a special interest in sustainability, supporting local and small businesses, or backing a project that solves a common problem.

You may find the best donations come from your inner circle. Friends, family, and social media acquaintances are more likely to provide aid than strangers. However, there are crowdfunding platforms that help you share your campaign to reach a broader spectrum of people.

Might also interest you:

- The ultimate step-by-step guide to eCommerce seller financing

- Permanent working capital: What it is and why it matters

- eCommerce funding: which option is right for you?

2. Reward crowdfunding

Reward crowdfunding is when you offer some type of non-monetary reward in exchange for investments. These rewards can include samples of your products, discounts and coupons, office supplies with your logo on it, t-shirts, experiences, or anything else that you might want to give away to attract donors.

Make sure you can deliver on any reward you promise your backers. If the reward you offer is more than you can afford, you might want to choose a different option.

Crowdfunding rewards are usually tiered in order to encourage people to give more money in exchange for a more desirable reward. The more money someone invests in your project, the better their prize. It can be difficult to get people interested in your business, but people love gifts and rewards.

Even though they’ve given you money, they’ll still feel like they’ve won something. In addition, they’ll feel more connected to your business and invested in your success. Reward crowdfunding puts money in your campaign while still showing appreciation to your donors.

Here are some examples of rewards you can use for reward crowdfunding:

- Patches, stickers, or products with your logo

- A beta model of your product (Ask them to review it, then post their review on your website or next crowdfunding campaign to encourage more sales.)

- Discounts or coupons for your store

- Shoutouts on your social media

- Regular updates on your progress

- Early-bird offers

- Invites to exclusive events such as a dinner with you

It’s important to ensure whatever you offer to your customers is something you can deliver. Don’t promise something that you can’t afford to give.

3. Equity crowdfunding

Equity crowdfunding is a great way to attract investors. With this type of crowdfunding, you receive multiple small investments from a variety of investors. In exchange, you give the investors minority shares of your company. This means you will commit to paying out dividends of your profits to these investors.

As with reward crowdfunding, you can offer tiers to attract higher investments. For example, for $1,000, your investors receive 0.5% of your company. For $5,000 they’ll receive 1.5%. Of course, these numbers should be individually tailored to your campaign and what you can afford.

With equity crowdfunding, instead of paying back your investors by a certain date, you pay them a certain percentage of your profits until they agree to sell the shares back to you. Once you buy those shares back, you return to having complete control of your company.

Remember that selling shares of your company means you relinquish total ownership of your business. You will be beholden to the shareholders whose main concern is receiving their payout. The investors may require updates and request changes to increase profits. Your shareholders are now your partners, which means they participate in the profits and the losses. The investors are taking the risk because if you don’t make money, neither do they.

If you do choose to offer stake in your company, make sure you are not relinquishing majority ownership. When you give up majority ownership, you are no longer the one in control of your business.

4. Debt crowdfunding

Debt crowdfunding is like taking out a bunch of small loans from different lenders. That’s because you agree to pay each investor back for the money they give you, plus interest. Each loan may have its own terms, rates, and considerations.

Popular content

- 14 strategies to improve your eCommerce business’s financial health

- 50+ ChatGPT prompts to elevate your eCommerce business

- A guide to pricing your product on Amazon

- 5 marketing metrics all eCommerce businesses should track

- All about Amazon PPC

Many startups and small businesses do not have the credit or collateral required to qualify for a traditional loan. Debt crowdfunding is an alternative that allows you to take out smaller loans from multiple lenders, adding up to the amount of capital you need.

However, debt crowdfunding isn’t the best option for everyone. Managing micro loans can be daunting and downright difficult. When you add interest on top of your capital, your payments could add up to be higher than your sales. So choose wisely how you accept and manage debt crowdfunding offers.

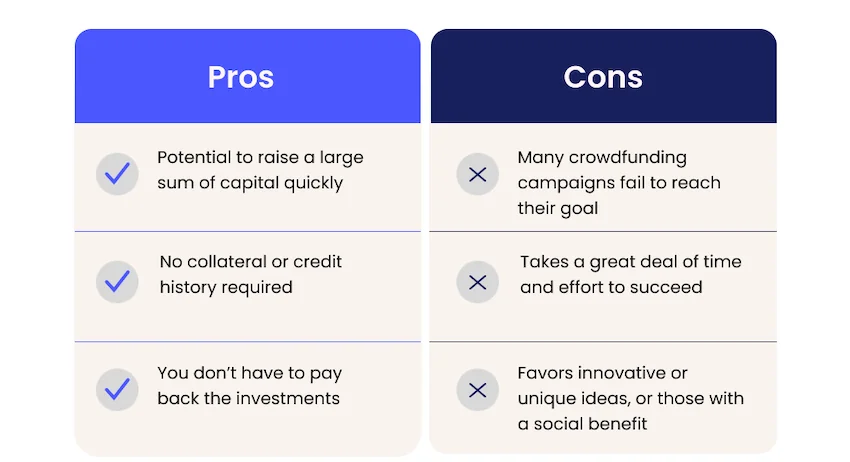

Pros and cons of crowdfunding

As with any funding solution, there are a number of benefits and downsides to crowdfunding.

Benefits of crowdfunding

With crowdfunding, you have the potential to raise large sums of capital relatively quickly. No collateral is required and you don’t need to have a good credit history to qualify. In addition, you can choose which type of crowdfunding works best for you. You may not have to pay back the money, or you can choose to reward investors with gifts or equity. You’ll also have the opportunity to text the market before you launch to gauge interest in your business idea.

Downsides of crowdfunding

While crowdfunding is a great solution for some business owners, it’s not for everyone. Crowdfunding works best if you have an innovative or unique idea, and even then, a large percentage of crowdfunding campaigns don’t reach their goals. Getting the funding you need through crowdfunding is not a sure thing.

In addition, it can take a lot of time and effort to create an effective campaign, promote it, manage it, and acquire investments. Some crowdfunding platforms are “all or nothing” platforms, which means that if you don’t reach your funding goals, you walk away with nothing.

How to choose a crowdfunding platform

There are many crowdfunding platforms out there, and it can be difficult to decide which one suits you. There are four key factors to consider when it comes to choosing a crowdfunding platform.

When choosing a crowdfunding platform, take a look at the fees, how long it will take to receive your funds, the platforms reach, and the terms before making a commitment.

Price / fees – Facilitating crowdfunding is a business and some platforms take advantage of the need for funds more than others. Carefully review the fees and costs that are tacked on to your campaign. Some websites charge a flat monthly fee, others will charge a percentage of the total along with a transaction fee, and others will combine the two. Find a site that allows you to keep as much of your funding as possible.

Funding schedule – Do you want your money now or later? Generally speaking, most crowdfunding websites hold your funds until you reach a goal or your campaign expires. There are a few out there, though, that will give you access to the funds after each donation is made.

Reach – Using a smaller service may come with cheaper fees, but it may not bring in the amount of investments you need. It’s a good idea to research your platform’s success rate before making a commitment. This should tell you what percentage of crowdfunding campaigns are successfully funded.

Terms – How long do you want to promote your campaign? Are you interested in attracting investors or donors? You have to find out if your crowdfunding platform will allow you to operate for the amount of time you need and receive the type of funding you are looking for.

When you don’t reach your crowdfunding goal

When you start your campaign and see the funds start to roll in, it can be exciting. But sometimes, the investments stop before you’ve reached your goal. That’s why it’s important to keep making an effort with your campaign until the very end.

Some crowdfunding platforms have an all-or-nothing policy. This means that if you don’t reach your goal, you get none of the funding, and it reverts back to the donors. Others are more lenient and allow you to collect partial funding, even if you don’t reach your funding target. While all-or-nothing platforms are a deterrent to many crowdfunders, they are fully funded twice as often as keep-it-all style platforms.

An alternative funding solution

If you’re looking for funding for your eCommerce business but crowdfunding isn’t for you, 8fig is another eCommerce financing solution.

8fig is a growth and funding platform exclusively for eCommerce sellers. We offer fast, continuous, and flexible capital. Instead of one lump sum, you get cash injections aligned to your supply chain needs, which keeps the cost of capital to a minimum. You can also change your payments and remittances as you need to fit the natural ups and downs of your sales. 8fig is designed to optimize your cash flow, so you’ll be able to take your business to the next level.

If you sell a product online and have made at least $100,000 in annual revenue, 8fig might be a great solution for you. Sign up for free today and find out how 8fig can help you grow your eCommerce business.

Have article ideas, requests, or collaboration proposals? Reach out to us at editor@8fig.co – we’d love to hear from you.

- 8 eCommerce strategy tips: Lessons from building a global art brand

- Firing up the small business spirit: How to motivate your team without breaking the bank

- How financial technology is transforming online shopping

- BFCM: The ultimate guide to eCommerce sales [2024]

- Seasonal or regular: Discover your seller type

Subscribe to the eCommerce newsletter for

top industry insights

to our blog

Read the latest

from 8fig

Overhead costs quietly eat into your margins – unless you know how to outsmart them. These four strategies will help you cut the fat and grow leaner, faster.

Selling more doesn’t mean that you have to be pushy. Learn how to upsell the smart way, with real eCommerce examples.

Amazon’s Big Spring Sale starts March 25 – here are 9 quick tips to help sellers prep, boost visibility, and stay competitive through the rush.