- What is eCommerce seller funding?

- Why funding is critical for eCommerce sellers

- Why do eCommerce sellers need funding?

- Steps to take before seeking funding

- Exploring eCommerce seller funding: Types, benefits, and drawbacks

- Case study: Real-world application of funding solutions

- How to choose the right type of funding

- Questions to ask before getting funded

- Conclusion

Navigating the world of eCommerce can be tricky, especially when it comes to finding the right funding for your business. Whether you’re just starting out or scaling up, this guide breaks down everything you need to know about eCommerce seller financing.

If you’ve ever wondered how funding works or how it can help grow your business, you’re in the right place – let’s walk through the essential steps to getting the financial support you need.

What is eCommerce seller funding?

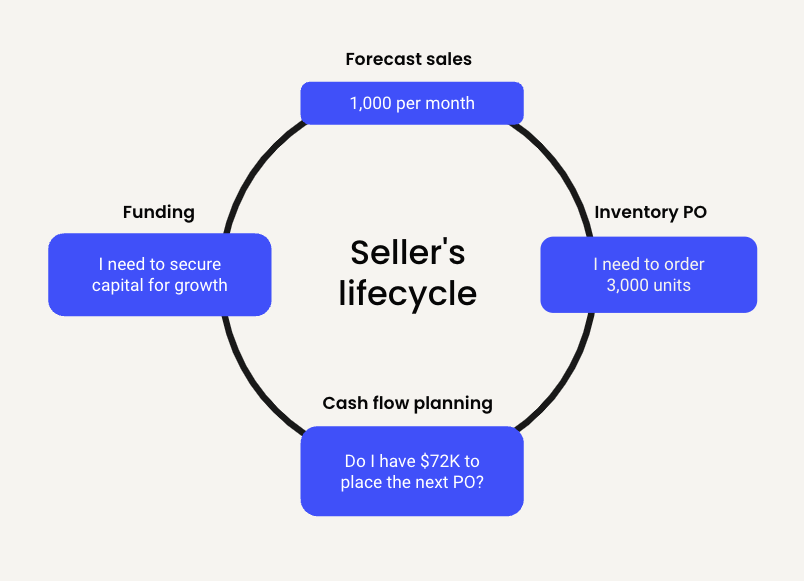

In a nutshell, eCommerce seller funding is about getting the financial support you need to keep your business running smoothly. Think of it as fuel for your business’s growth, helping you cover costs like inventory, marketing, or even scaling up operations.

There are different types of funding out there, like working capital loans or inventory financing – each one designed to fit specific business needs. The goal? Making sure you have available cash when you need it most, without the stress of financial gaps.

Why funding is critical for eCommerce sellers

For eCommerce businesses, securing funding is more than just an option – it’s a necessity.

Without the right financial backing, keeping up with inventory, marketing, and daily expenses can become overwhelming, especially when you’re scaling.

Funding allows sellers to manage cash flow, meet demand during busy seasons, and invest in growth opportunities.

In short, it helps turn ambitious goals into reality, ensuring your business has the resources to thrive.

Why do eCommerce sellers need funding?

Running an eCommerce business presents its own unique challenges, particularly when it comes to funding:

Subscribe to the eCommerce newsletter for

top industry insights

Cash flow gaps

Cash flow can be unpredictable in eCommerce, with seasonal dips or shipping delays causing hiccups. Unlike brick-and-mortar stores that rely on consistent foot traffic, eCommerce sellers may experience large fluctuations in revenue.

Funding helps keep the lights on – covering operational expenses like website hosting, fulfillment costs, and advertising – when sales slow down.

Scaling challenges

Scaling up in eCommerce can be very expensive. Sellers need to invest in marketing campaigns, expand their inventory, and optimize their tech stack (think about website improvements, inventory management software, etc.). Brick-and-mortar stores face physical limitations when scaling, but digital stores need more bandwidth to handle growth, which requires additional capital.

Funding ensures that sellers have the resources to grow without stretching their budget too thin.

Seasonality

For many eCommerce sellers, busy seasons like Black Friday, Cyber Monday, and holiday sales require significant upfront investment in inventory, packaging, and promotional efforts.

Unlike brick-and-mortar stores, which may have more predictable foot traffic, online sellers often experience extreme spikes and lulls. Funding helps them stay prepared for busy times and cover costs during off-seasons.

Unique expenses for eCommerce sellers

Digital stores face specific costs that their brick-and-mortar counterparts don’t, like:

- Shipping and fulfillment: Unlike physical stores where customers pick up items, eCommerce sellers need to navigate the complex world of shipping and fulfillment. This involves managing relationships with fulfillment centers, shipping partners, and ensuring timely deliveries. Add in the tricky task of handling returns, which requires an efficient system to process returned items, restock inventory, and manage customer refunds – all without disrupting the workflow.

- Digital infrastructure: Running an online store comes with a range of tech-related costs. Beyond just setting up a website, eCommerce sellers need to maintain ongoing expenses like server hosting, software integrations, cybersecurity to protect customer data, and tech support to handle any glitches. These are crucial for keeping the business up and running, whereas brick-and-mortar stores rely more on physical upkeep than digital infrastructure.

- Advertising and marketing: Unlike brick-and-mortar stores that can rely on local foot traffic, eCommerce businesses need a more aggressive approach to attract customers. Digital marketing is a significant investment, covering everything from search engine optimization (SEO) to paid ads on platforms like Google and Facebook. Sellers also need to focus on social media marketing and email campaigns to engage customers and keep them coming back, making digital outreach a continual and essential expense.

| Expense category | eCommerce stores | Brick-and-mortar stores |

|---|---|---|

| Rent and utilities | Low (only for office / warehouse) | High (storefront rent, utilities, property maintenance) |

| Staff salaries | Depends on scaling (customer service, warehousing) | High (store staff, customer service) |

| Inventory management | Centralized through fulfillment centers or dropshipping | Managed locally (storage, shelf stocking) |

| Shipping and fulfillment | High (shipping partners, fulfillment centers, returns) | Minimal (in-store pickup) |

| Digital infrastructure | High (website hosting, cybersecurity, software) | Low (basic digital infrastructure) |

| Marketing and advertising | High (SEO, PPC ads, social media, email campaigns) | Moderate (local ads, print media, community outreach) |

| Point of sale systems | Digital payment gateways | Physical POS terminals |

| Customer support | Remote customer support, chatbots | In-store staff, face-to-face interaction |

By recognizing and addressing these challenges, funding gives eCommerce sellers the flexibility to manage their operations, scale smoothly, and take advantage of seasonal opportunities.

Steps to take before seeking funding

Before jumping into funding, it’s crucial to get a clear picture of your business’s financial health. Think of it like going to the doctor – you wouldn’t start treatment without a diagnosis, right?

Tools like 8fig’s financial dashboard help you see the full scope of your cash flow, profits, and expenses, which is key to making informed decisions.

So what do you need to have when you approach funding companies, to show them you’re prepared?

1. Profit and loss statements

Your P&L statement shows the full story of your earnings versus expenses over a certain period. This document helps potential funding companies see how healthy your business is and whether it’s consistently profitable or experiencing dips.

2. Cash flow projections

Cash flow projections show how money moves in and out of your business over time. It’s essential to demonstrate that you can handle repayments, so lenders can trust that you have a plan in place for keeping up with day-to-day operations while managing debt.

3. Growth plans

You’ll want to show that you’re not just looking for funding to survive – but to thrive. Growth plans should outline your vision for scaling your business, whether it’s increasing product lines, expanding into new markets, or boosting your marketing efforts.

These plans will assure lenders that your business is on track for long-term success.

4. Sales forecasts

A solid sales forecast is crucial to convincing lenders that your business is set to grow. Show how past trends and current market data predict increased sales. Include specifics, like expected sales spikes during peak seasons, and how funding will support those surges.

By preparing these key documents, you’ll be in a better position to secure the right funding and demonstrate that your business is set up for success; you’ll also have a clearer picture of where your business stands and where it’s headed.

Might also interest you:

Popular content

- 14 strategies to improve your eCommerce business’s financial health

- 50+ ChatGPT prompts to elevate your eCommerce business

- A guide to pricing your product on Amazon

- 5 marketing metrics all eCommerce businesses should track

- All about Amazon PPC

- Why just-in-time funding is the future for eCommerce

- 7 reasons successful eCommerce sellers opt for funding to fuel growth instead of relying on profits

- 4 key eCommerce funding challenges and how to overcome them

Exploring eCommerce seller funding: Types, benefits, and drawbacks

When it comes to eCommerce funding, there’s no universal approach. Whether you’re borrowing from friends, partnering with investors, or securing a loan, each type of funding brings unique advantages and challenges.

It’s up to you to determine the best fit for your business, based on your needs, growth plans, and financial health. Let’s break it down:

Friends and family

Borrowing from close connections can be a useful starting point, especially for new businesses.

Friends and family loans are ideal for businesses that are just starting. The terms are usually quite generous – no interest, flexible repayment, and often no pressure for immediate returns. However, the amount is usually small, making it more of a short-term solution.

It’s also worth noting that mixing business with personal relationships can get tricky. If your business doesn’t perform as expected or delays repayment, it could strain your personal connections. This method isn’t scalable for long-term growth but can give you the breathing room to get started.

- Pros: No interest rates, typically longer repayment periods with flexible terms.

- Cons: Limited to smaller amounts, potential for personal conflict, not sustainable long-term.

Crowdfunding

Crowdfunding allows you to raise capital from the public by offering rewards or pre-sales in exchange for contributions.

Platforms like Kickstarter and Indiegogo have made crowdfunding a popular option for eCommerce businesses. You can raise money without taking on debt, and in return, contributors often receive early access to your product or exclusive rewards.

Crowdfunding also offers great exposure, helping you test the market before launching. However, running a successful campaign is no small feat – it takes significant marketing effort, and even with that, many campaigns don’t hit their targets. If that happens, you’re left without funding after pouring time and resources into promotion.

It’s a great option for launching new products but less reliable for ongoing funding needs.

- Pros: No interest rates, rewards instead of repayment, exposure for your product.

- Cons: Time-intensive, high marketing demands, campaigns may fail.

Angel investors

Wealthy individuals who invest in exchange for equity.

Angel investors can be a game-changer for eCommerce sellers with big growth ambitions. These investors provide not only capital but also valuable advice and introductions to industry experts and potential partners.

However, working with an angel investor means giving up a portion of your ownership, which can dilute your control over the company. They’ll likely have a say in how you run your business, and their stake can grow over time.

If you’re looking for strategic support in addition to funding, this can be a strong option – just be prepared for less autonomy.

- Pros: Access to significant capital, mentorship, and industry connections.

- Cons: You give up equity and some control over your business.

Venture capital

Venture capitalists invest in high-growth companies in exchange for equity, offering large sums of funding.

Venture capital (VC) is another route for rapidly scaling businesses. Unlike angel investors, VCs often come in as institutional investors, offering larger sums in exchange for a stake in your business.

With VC funding, you gain access to extensive networks, strategic support, and mentorship to fuel your business’s rapid growth. However, the trade-off is a substantial loss of equity and, often, control. VCs typically expect a say in major business decisions, and this could limit your ability to make autonomous choices in the future.

Venture capital is best suited for businesses aiming for fast growth and large-scale operations.

- Pros: Substantial funding, strategic guidance, and valuable connections to grow your business quickly.

- Cons: Significant equity stake, potential loss of decision-making power.

Traditional bank loans

Borrowing a fixed amount from a bank, with repayment plus interest over a set period.

Traditional bank loans are a well-known funding option. They tend to offer more favorable interest rates than newer, more flexible funding methods, and repayments are spread out over a long period. However, banks are often less familiar with eCommerce, making the process of getting approved slower and more difficult.

Banks usually require a track record of success, collateral, and specific financial documents. The terms of these loans can also be inflexible, so if you experience fluctuations in sales, the fixed repayment schedule can strain your cash flow.

- Pros: Reliable funding, lower interest rates, longer repayment periods.

- Cons: Inflexible terms, lengthy approval process, often requires collateral.

Lines of credit

Access to a revolving pool of funds, up to a set limit, that you can draw from as needed.

A line of credit can be a lifeline for businesses that need flexibility. You can borrow up to a certain limit and only pay interest on what you actually use, making it an ideal solution for managing cash flow. For example, if you need funds to cover a temporary shortfall, you can use just what you need and pay it back as you go.

The downside is that lines of credit typically come with lower limits than loans, and they can lead to poor spending habits if you’re not disciplined. Additionally, interest rates can fluctuate, and there may be fees for keeping the credit line open, making this option less predictable than others.

- Pros: Flexible borrowing, pay interest only on what you use.

- Cons: Lower credit limits, potential for high fees and interest, requires strong financial discipline.

Merchant cash advance (MCA)

A lump sum of cash provided in exchange for a percentage of future sales.

A merchant cash advance (MCA) is a popular choice for eCommerce sellers needing quick access to cash. The approval process is faster than traditional loans, and repayment is based on a percentage of future sales, making it a good fit for businesses with seasonal spikes in revenue.

However, the cost of capital is higher than other forms of funding, and if sales drop, you may find yourself repaying more than you initially expected. That said, the flexibility in repayment terms is a big advantage for businesses that can manage fluctuating sales.

- Pros: Quick access to funds, no collateral required, flexible repayment aligned with sales.

- Cons: Higher cost of capital, can be expensive over time.

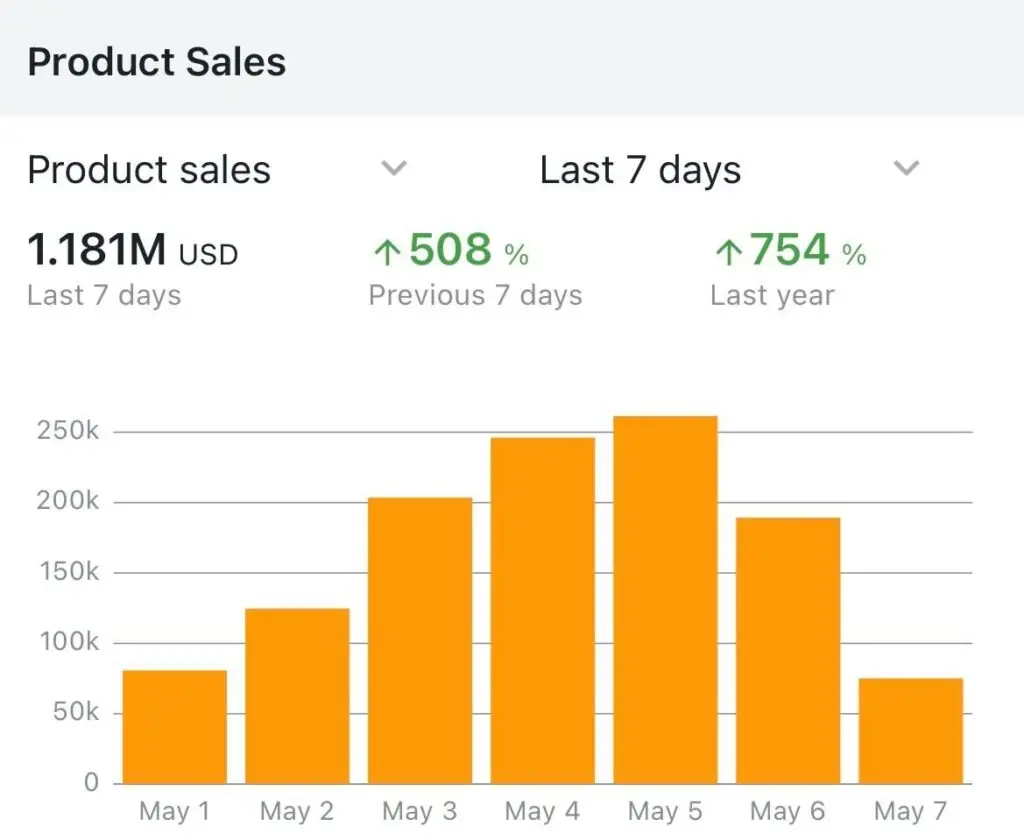

Case study: Real-world application of funding solutions

DAVAN Strategic, founded by David and Ryan, started as an eCommerce business that focused on selling seasonal holiday items. After years of growing their business, they transitioned into a consulting company, advising other eCommerce sellers on how to scale effectively. During their time as eCommerce sellers, David and Ryan faced a significant challenge that many sellers encounter – how to manage skyrocketing demand during the holiday season without running into cash flow issues or stock shortages.

The nature of their business required them to prepare months in advance for the holiday rush. This meant securing inventory, running extensive marketing campaigns, and managing fulfillment all while trying to avoid the financial strain that often accompanies seasonal peaks.

They found themselves in need of external funding to ensure they could meet the increased demand without jeopardizing their cash flow or missing out on potential sales.

David and Ryan sought a solution that would give them the flexibility to scale without risking long-term financial strain. With the right funding strategy in place, they were able to accurately forecast demand and secure the necessary inventory, ensuring they wouldn’t miss out on any potential sales. Additionally, they could allocate funds to run more robust marketing campaigns, which helped drive even more traffic to their store during this high-traffic period.

What’s notable about DAVAN’s approach is their ability to manage cash flow effectively during this crucial time. Instead of experiencing the typical cash flow gaps that plague many seasonal businesses, they had the liquidity to meet demand as it arose, keeping operations smooth and efficient.

ֿIn the end, this strategic use of funding not only helped them significantly increase their revenue during the holidays, but it also set them up for future growth, allowing them to build on their seasonal success without overextending themselves.

This case demonstrates how the right funding at the right time can make all the difference, turning a seasonal surge into a long-term advantage.

How to choose the right type of funding

Choosing the best funding option for your business requires careful consideration of several factors. The right funding will depend on the size of your business, your revenue patterns, your inventory needs, and your marketing expenses.

Business size

Larger businesses may require more substantial funding options, such as venture capital or bank loans, while smaller businesses might benefit from more flexible options like lines of credit or crowdfunding.

Revenue patterns

Does your business experience steady revenue year-round, or does it rely on seasonal spikes? If your income is more volatile, you might want funding that aligns with your sales cycles, like a merchant cash advance (MCA), where repayment is tied to future revenues. For businesses with steady cash flow, more structured loans or lines of credit could be the better option.

Inventory needs

If you need to consistently stock large quantities of inventory, a traditional bank loan or line of credit might be ideal, allowing you to purchase in bulk and manage cash flow effectively. On the other hand, if your inventory needs fluctuate with seasonality, just-in-time funding could provide the flexibility to meet demand during busy periods without holding excess stock in the off-season.

Marketing expenses

Marketing is critical for growing an eCommerce business, but it requires upfront capital. If you’re planning an extensive marketing campaign, you’ll need funding that can cover these costs without affecting other parts of your operation. Venture capital, angel investors, or traditional bank loans can provide the capital needed for major marketing pushes.

- Long-term funding is best suited for businesses looking to make significant investments for future growth. This type of funding typically comes with lower interest rates but requires a long-term repayment commitment.

- Short-term funding provides quick access to capital, often with higher costs or shorter repayment periods. This is ideal for businesses needing immediate liquidity, such as during seasonal spikes or when addressing short-term cash flow issues.

Ultimately, the right funding choice comes down to your business’s unique needs and growth goals. Balancing the benefits and drawbacks of each option is key to making a decision that supports both short-term operations and long-term scalability.

Questions to ask before getting funded

Before committing to any funding option, it’s crucial to ask the right questions. This will help you avoid surprises and ensure the funding solution aligns with your business’s needs.

We’ve listed here the top 5 questions we believe you should ask before approaching funding providers:

- What interest rates or fees will I pay?

Different funding options come with varying interest rates, fees, or percentages of sales. Understanding the total cost of capital upfront is essential to avoid unexpected charges. Compare these rates across multiple funding providers to get the best deal. - How flexible are the repayment terms?

Flexibility is key, especially if your business has fluctuating revenue. Will your payments adjust if your income dips, or are the terms fixed? Look for funding with repayment schedules that align with your cash flow, particularly during slow periods. - Does the funding provider offer added support?

Beyond the money, some funding providers offer advisory services, tools, or mentorship to help your business succeed. Ask if they provide extra support, like a virtual CFO or business advisory services, to help guide your financial strategy. - What happens if my business dips?

If your sales decline unexpectedly, it’s important to know how your funding provider will handle it. Some might offer deferred payments or lower rates during slow periods, while others may have more rigid repayment requirements – it’s crucial to know before you make this decision. - What are the potential risks of underfunding or overfunding?

Underfunding can leave you scrambling for cash during crucial moments, while overfunding can lead to unnecessary debt or misuse of funds. Consider your exact needs and plan carefully to ensure you’re securing the right amount to support growth without overstretching your budget.

By answering these questions before finalizing your funding decision, you’ll be in a better position to choose a funding solution that fits your business’s needs both now and in the future.

Conclusion

Funding is a key component in building and sustaining a successful eCommerce business. Whether it’s covering inventory, managing marketing expenses, or navigating seasonal spikes – the right funding can provide the stability and flexibility needed to grow. By carefully evaluating your options, asking the right questions, and securing the right amount of capital, you set your business up for long-term success.

If you’re looking for personalized funding solutions tailored to your unique business needs, 8fig offers strategies that align with your growth goals while maintaining flexibility.

Have article ideas, requests, or collaboration proposals? Reach out to us at editor@8fig.co – we’d love to hear from you.

- Behind the scenes: The creative process at Ugly Wolf and the power of personal branding

- How to optimize your supply chain for the holiday season

- Top SMS strategies for eCommerce (Including examples)

- How to write Amazon titles and product descriptions that convert – with real examples

- Effective budgeting techniques for small businesses

She's a former English teacher who's passionate about the written word, all while embracing the AI revolution and its countless benefits.

Subscribe to the eCommerce newsletter for

top industry insights

to our blog

Read the latest

from 8fig

Overhead costs quietly eat into your margins – unless you know how to outsmart them. These four strategies will help you cut the fat and grow leaner, faster.

Selling more doesn’t mean that you have to be pushy. Learn how to upsell the smart way, with real eCommerce examples.

Amazon’s Big Spring Sale starts March 25 – here are 9 quick tips to help sellers prep, boost visibility, and stay competitive through the rush.